In the early stages of the coronavirus pandemic, when many Americans sought sanctuary in their homes, food delivery sales rose to record heights. Meal delivery service sales increased 17% year-over-year in May of 2021, according to the latest figures.

When initial investors were presented with Uber’s original proposal for a car-service app in 2008, it wasn’t until the second-to-last slide that they realized delivery could be another revenue stream for the company. Delivery is no longer an afterthought six years later.

On this page you’ll find:

- Uber Eats key statistics

- Uber Eats overview

- Uber Eats Revenue

- Uber Eats Gross Bookings

- How much does it cost Uber Eats to deliver a $40 food order?

- Uber Eats Supported Restaurants

- Cities in the United States where Uber Eats is the most popular food delivery service

- Strongholds of Uber Eats (and competitors) in various metro areas

- Uber Eats’ market share in the United States

- Uber Eats Acquisitions

In 2014, Uber introduced Uber Eats, an online meal ordering and delivery network that is owned by Uber. iOS and Android users can use a mobile application to view menus, reviews, and ratings, order food, and pay via a web browser or mobile app. On top of that, customers have the option to tip when their food is delivered.

Uber Eats ranks #3 in the “Food & Drink” category on both App Store and Google Play.

Payment is billed to the card linked to the customer’s Uber account. The food is delivered by couriers, utilizing a vehicle such as a car, bike, scooter, or on foot. It is operational in more than 500 cities around the world and is growing.

According to the most recent data, DoorDash and its subsidiaries accounted for 56% of meal delivery sales to US consumers in May 2021, while Uber Eats came in second place with 23%. Postmates won 4% of the meal delivery market in the United States in May, and since Uber decided to acquire food delivery start-up Postmates for $2.65 billion last year, Uber’s total market share has increased to 27%. Grubhub and its subsidiary companies, which include Seamless and Eat24, accounted for 16% of the market while Waitr, which is one of the smaller services in the business, achieved 1% of the total sales nationally.

According to Uber Eats’ website, restaurants are charged 30% for delivery and 15% for pick-up, unless a restaurant tries to negotiate a lower cost. Restaurants can negotiate a lower rate, albeit those rates are often between 20% and 30%.

In the event of a pandemic, businesses that offer meals will likely see success, but investors are concerned that even after Uber tripled its gross bookings, it still failed to turn a profit.

However, Uber Eats has recorded decreasing losses on an annual basis, so it may become profitable when the market consolidates.

Dark kitchens are used by Uber Eats (and other meal delivery services) to cut costs and transform the $863 billion American restaurant industry. While more customers are ordering food to consume in the home, and delivery is more reliable and convenient, apps are fundamentally changing the business of running a restaurant.

Restaurateurs no longer have to rent out space for a dining room. Any kitchen, or even a small fraction of one, will do. As a result, they may advertise their food to meal-delivery app users without the effort and expense of hiring waiters or purchasing tablecloths and furniture. Users don’t realize that the restaurant doesn’t physically exist if they order from the apps.

Uber Eats key statistics

- Uber Eats made 4.8 billion US dollars in 2020, a 152 percent growth year over year.

- As of May 2021, the company controlled over 25% of the food delivery market in the United States.

- Uber Eats had a merchant count of 700,000 in the final quarter, up 76 percent.

- Uber Eats’s average delivery time is 30 minutes.

- UberEats spends $43.5 to deliver an average $40 order.

Uber Eats overview

| Launch date | August 2014 |

| Headquarters | 1515 3rd Street San Francisco, California 94158 |

| Founders | Travis Kalanick, Garrett Camp |

| Key people | Dara Khosrowshahi (Chief Executive Officer), Nelson Chai, (Chief Financial Officer), Jill Hazelbaker (Senior Vice President, Marketing and Public Affairs), Nikki Krishnamurthy (Senior Vice President and Chief People Officer), Tony West (Chief Legal Officer and Corporate Secretary) |

| Type | Subsidiary |

| Owner | Uber |

| Industry | Food delivery |

Uber Eats Revenue

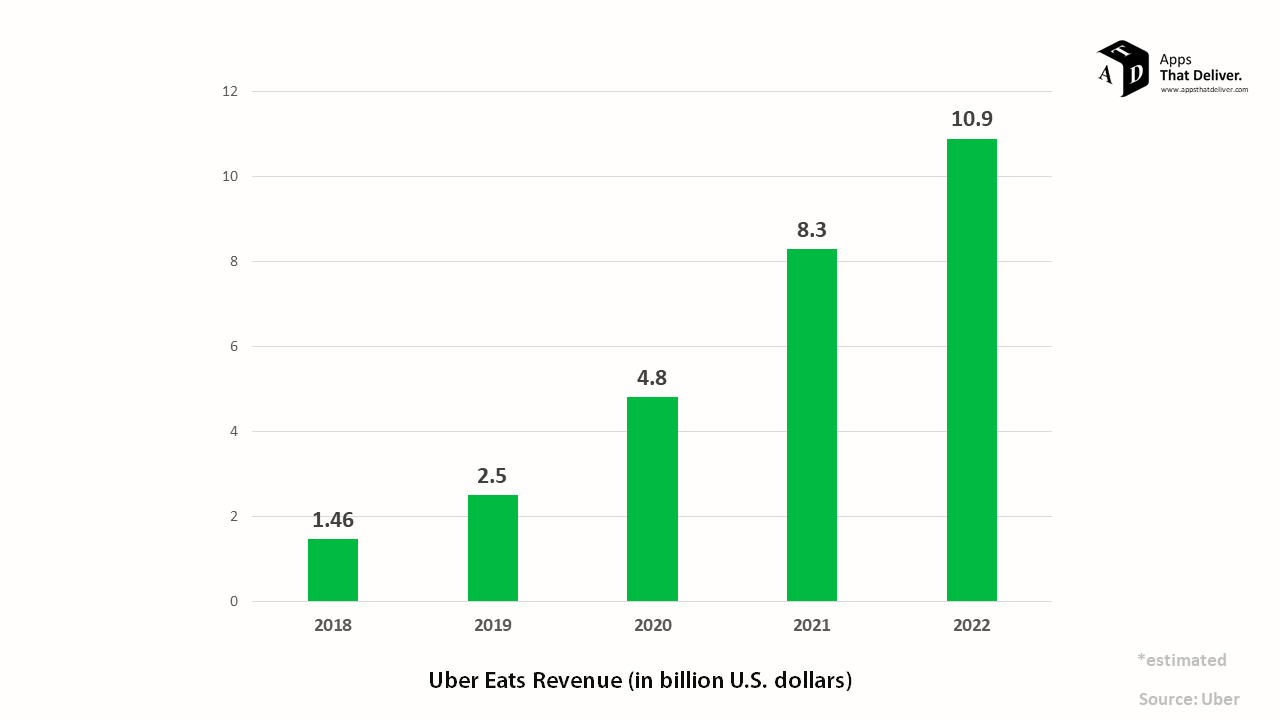

In many developed economies, the 2020 lockdowns facilitated the growth of couch commerce and increased participation with food delivery services such as Uber Eats.

As a result, the Uber ride-hailing giant’s online food ordering and delivery division saw a significant boost in a variety of indicators, including an estimated 152 percent year-over-year increase in revenue.

Uber Eats generated $4.8 billion in revenue in 2020 and $8.3 billion in 2021, representing a 73 percent year-on-year increase.

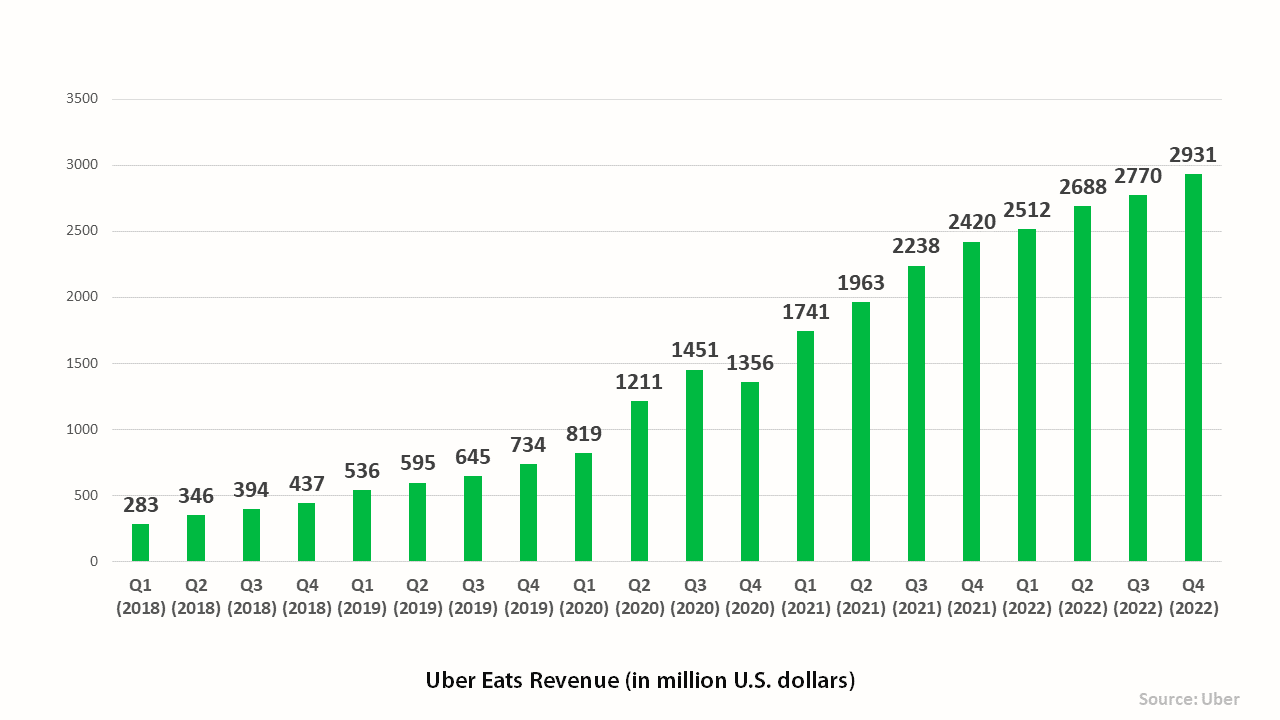

| Year | Revenue |

| 2018 | |

| Q1 | $283 million |

| Q2 | $346 million |

| Q3 | $394 million |

| Q4 | $437 million |

| 2018 [Q1+Q2+Q3+Q4] | $1.46 billion |

| 2019 | |

| Q1 | $536 million (up by 89%) |

| Q2 | $595 million (up by 72%) |

| Q3 | $645 million (up by 64%) |

| Q4 | $734 million (up by 68%) |

| 2019 [Q1+Q2+Q3+Q4] | $2.5 billion (up by 71%) |

| 2020 | |

| Q1 | $819 million (up by 53%) |

| Q2 | $1,211 million (up by 104%) |

| Q3 | $1,451 million (up by 125%) |

| Q4 | $1,356 million (up by 85%) |

| 2020 [Q1+Q2+Q3+Q4] | $4.8 billion (up by 82%) |

| 2021 | |

| Q1 | $1,741 million (up by 113%) |

| Q2 | $1,963 million (up by 62%) |

| Q3 | $2,238 million (up by 54%) |

| Q4 | $2,420 million (up by 78%) |

| 2021 [Q1+Q2+Q3+Q4] | $8.3 billion (up by 73%) |

| 2022 | |

| Q1 | $2,512 million (up by 44%) |

| Q2 | $2,688 million (up by 37%) |

| Q3 | $2,770 million (up by 24%) |

| Q4 | $2,931 million (up by 21% ) |

| 2022 [Q1+Q2+Q3+Q4] | $10.9 billion (up by 31%) |

Source: Uber

Uber Eats Gross Bookings

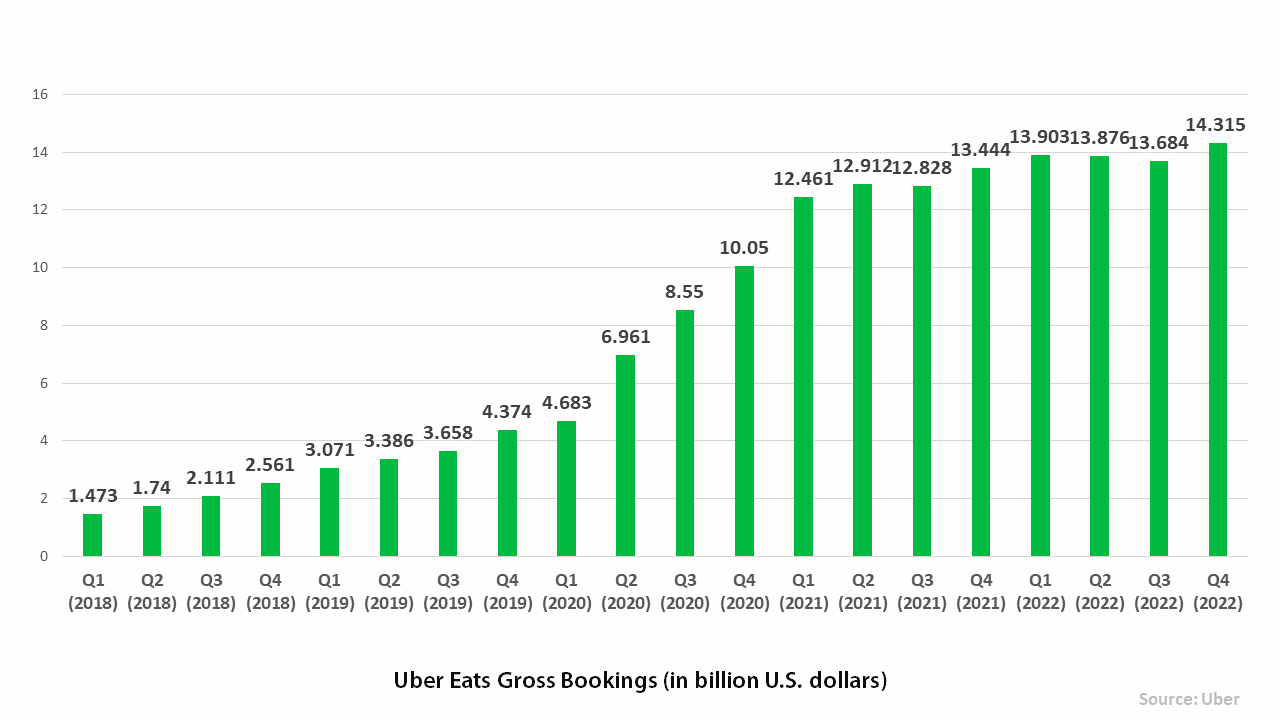

With lockdowns in several regions of the world still in effect, Covid-19 is reshaping how Uber operates.

Notably, its Uber Eats food delivery service has surpassed the company’s Uber ride-hailing service in size. Uber Eats’ gross bookings more than doubled to $12.46 billion in the first quarter of 2021.

Profit margins in the food delivery market can be razor-thin, and because more parties are engaged in food delivery than in ride-hailing, Uber retains a smaller percentage of gross bookings.

| Year | Gross bookings |

| 2018 | |

| Q1 | $1.473 billion |

| Q2 | $1.74 billion |

| Q3 | $2.111 billion |

| Q4 | $2.561 billion |

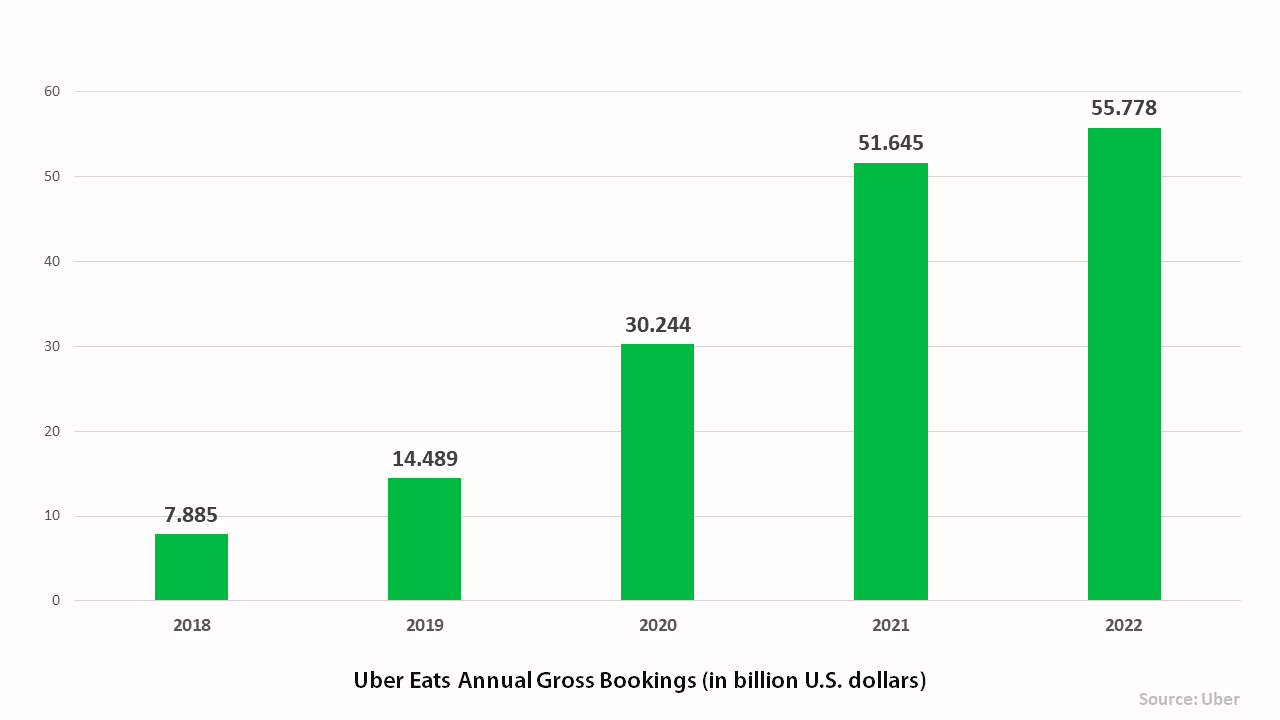

| 2018 [Q1+Q2+Q3+Q4] | $7.885 billion |

| 2019 | |

| Q1 | $3.071 billion (up by 108%) |

| Q2 | $3.386 billion (up by 91%) |

| Q3 | $3.658 billion(up by 73%) |

| Q4 | $4.374 billion (up by 71%) |

| 2019 [Q1+Q2+Q3+Q4] | $14.489 billion (up by 84%) |

| 2020 | |

| Q1 | $4.683 billion (up by 52%) |

| Q2 | $6.961 billion (up by 106%) |

| Q3 | $8.550 billion (up by 134%) |

| Q4 | $10.050 billion (up by 130%) |

| 2020 [Q1+Q2+Q3+Q4] | $30.244 billion (up by 109%) |

| 2021 | |

| Q1 | $12.461 billion (up by 166%) |

| Q2 | $12.912 billion (up by 85%) |

| Q3 | $12.828 billion (up by 50%) |

| Q4 | $13.444 billion (up by 34%) |

| 2021 [Q1+Q2+Q3+Q4] | $51.645 billion (up by 71%) |

| 2022 | |

| Q1 | $13.903 billion (up by 12%) |

| Q2 | $13.876 billion (up by 7.5%) |

| Q3 | $13.684 billion (up by 6.6%) |

| Q4 | $14.315 billion (up by 6.4%) |

| 2022 [Q1+Q2+Q3+Q4] | $55.778 billion (up by 8%) |

Source: Uber

How much does it cost Uber Eats to deliver a $40 food order?

During the pandemic, food delivery companies set new records in sales to Americans who were unable to leave their homes. Their valuations rose significantly. They gained huge amounts of information, which allowed them to improve their effectiveness. At the peak of their success, the only difficulty was that they weren’t profitable.

UberEats spends $43.5 to deliver an average $40 order.

Source: Menabytes

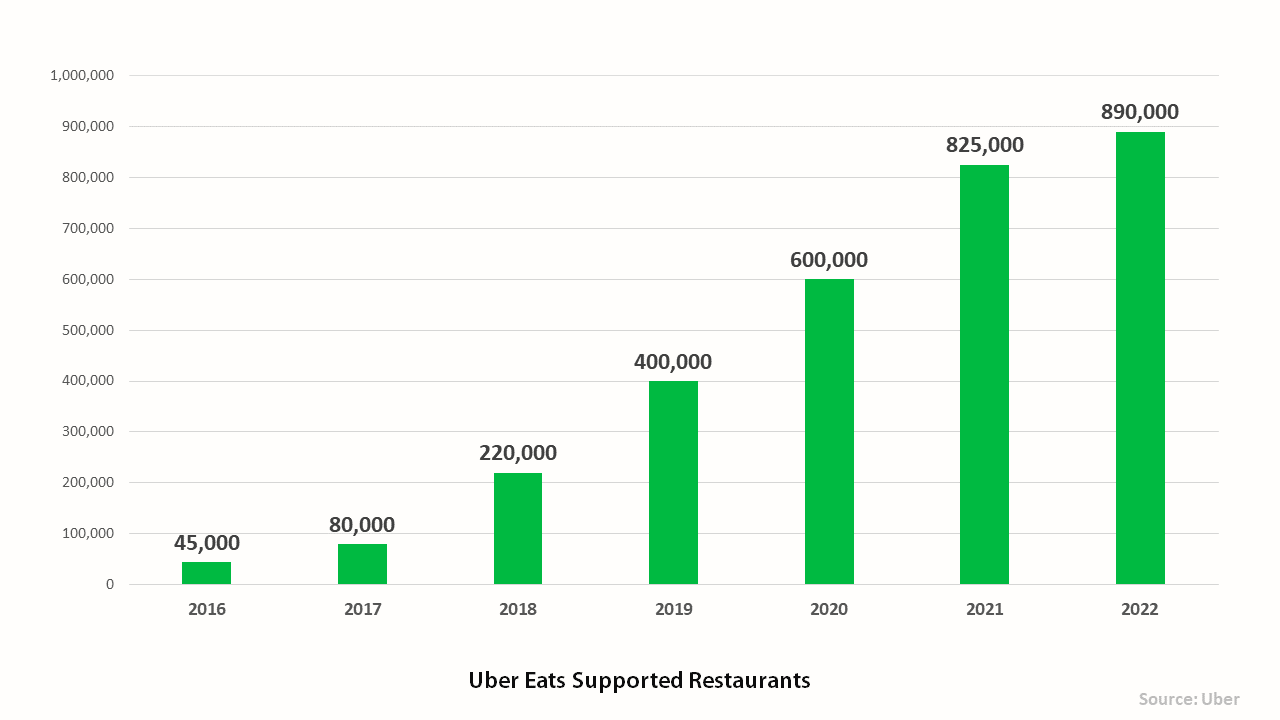

Uber Eats Supported Restaurants

Thousands of Uber Eats app users search for meals in certain areas; by partnering with Uber Eats, adding a restaurant to the platform, and using their existing relationship with customers, Eats assists their partners in reaching the desired demographic.

The one-time $350 activation charge covers a tablet, installation of the Uber Eats order software, a food photoshoot, and support throughout the setup.

Additionally, a marketplace fee is levied on each order fulfilled by the restaurant for clients using the Uber Eats app. It varies depending on the partner’s preferred method of order delivery.

| Year | Supported Restaurants |

| 2016 | 45,000 |

| 2017 | 80,000 |

| 2018 | 220,000 |

| 2019 | 400,000 |

| 2020 | 600,000 |

| 2021 | 825,000 |

| 2022 | 890,000 |

Source: Uber

Cities in the United States where Uber Eats is the most popular food delivery service

This statistic displays the cities in the United States where Uber Eats was the most popular meal delivery service in April 2021.

Uber Eats has the biggest sales share in Miami, accounting for 55% of total sales when compared to other food delivery services. In comparison, the meal delivery service had the lowest sales share in San Francisco, accounting for only 11% of total sales over the same period.

Source: Statista

Strongholds of Uber Eats (and competitors) in various metro areas

Food delivery services are well-established in several urban areas. For instance, Grubhub and Doordash are the most popular food delivery services in New York, while Uber Eats is the most popular in Miami.

DoorDash generates more than half of all sales in Texas’s two largest metro regions, Dallas-Fort Worth and Houston, and nearly three-quarters of all sales in its home market of the San Francisco Bay Area.

Source: SecondMeasure

Uber Eats’ market share in the United States

Due to the severe coronavirus epidemic, the U.S. economy has been severely affected and businesses of all kinds have been deeply affected, ranging from worldwide shipping, cruise lines, and restaurants. Nevertheless, food delivery startups are doing well. Notably, DoorDash hopes to be a one-of-a-kind winner in its area.

Uber Eats, a food delivery service, captured 24% of the entire food delivery market in the United States in 2018. By 2022, the company’s market share is expected to reach 30%.

Source: Statista

Uber Eats Acquisitions

| Company | Acquisition Date |

| Ando | Jan 22, 2018 |

| orderTalk | May 22, 2018 |

| Careem | January 02, 2020 |

| Postmates | Dec 1, 2020 |

| Drizly | Oct 13, 2021 |

Uber Eats bought David Chang’s latest venture, Ando, in January 2018. Ando is a delivery-only lunch menu that runs out of a few industrial kitchens in Manhattan. The deal’s details were not disclosed.

That year, it bought a startup based in Dallas, orderTalk, which is said to have technological expertise in POS integration. There were no specific details revealed. Postmate, another third-party delivery provider, was recently acquired for about $2.65 billion. Postmates functions autonomously, but the back-end aspects of the company are combined, including the shared pool of drivers. After completing the deal, Uber Eats dropped around 185 employees or 15% of the staff at Postmates Inc.

Additionally, Uber revealed its intention to acquire Drizly, an on-demand alcohol delivery service, for $1.1 billion. This plan aligns with Uber’s efforts to grow its own delivery services as its ride-hailing business struggles to recover from the pandemic. However, the acquisition has not yet been completed.