To start a painting business in Arizona, you must follow certain steps. These resources will assist you in starting a residential painting business, a commercial painting business, or just about any form of the painting business.

How To Start A Painting Business In Arizona

- Benefits of starting a painting business in Arizona

- Write a Business Plan

- Determine your business legal structure

- How to Register your Painting Business Name in Arizona

- Employer Identification Number (EIN)

- Open a Business Checking Account

- Get Liability Insurance

- Get Health Insurance

- Final Thoughts

Benefits of starting a painting business in Arizona

Entrepreneurship is on the rise in several states, including Arizona. During the third quarter of 2019, new business applications increased from 19,052 to 30,356. Similarly, Phoenix ranks tenth in the U.S. for starting a business, and second for creating net new business.

Entrepreneurs that live in Arizona can profit from a rising workforce throughout the state and an increasing skill set thanks to Arizona State University. Also, Arizona’s business makeup includes a big role for small businesses. More than 95% of the firms in Phoenix have 50 employees or fewer.

Complete Guide: How to Start a Painting Business

Write a Business Plan

You may have a million ideas for this new painting business rushing through your mind right now. Putting those thoughts on paper can assist you in determining whether or not those ideas are viable, what areas you may be overlooking, and how to best position this desire for eventual achievement.

As you recall, you will have an infinite number of angel investors or banks that will supply you with the capital to establish a painting business in Arizona. This business plan will wow them too. Thus, make your business plan outstanding by taking the time to craft a top-notch effort.

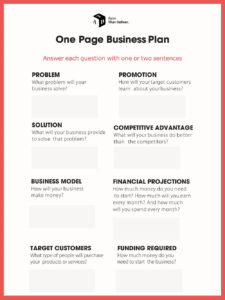

Create a One-Page Business Plan

You should be able to complete your one-page business plan in less than 20 minutes. It’s super-simple: Print our free PDF template and write down one to two sentences to the questions in the free template below:

Download template: PDF

Determine your business legal structure

Now is the moment to decide the company organization you will form. Sole proprietorships and limited liability companies are frequently found in Arizona (LLC). Before making your decision, critically analyze the benefits and risks of each option.

A sole proprietorship is a basic business organization in which one owner has the sole financial and operational control. A little known fact is that this new concept does not require state registration and has a very easy tax system. Your personal return and your schedule detailing your sole proprietorship’s losses and earnings are also part of your return.

The great advantage of a single proprietorship is that it enables businesses to segregate their business and personal assets and obligations. You might potentially jeopardize your personal property, including money, real estate, or other assets in your business. Also, it is likely to be more difficult to obtain long-term funding, as businesses must pay taxes quarterly, instead of annually.

The proprietors of an LLC, known as members, for example, might be one or numerous people. You may be able to reduce your personal liability exposure by keeping company obligations separate from your personal assets, and by taking advantage of the potentially lower taxes businesses must pay.

While you will need to file the necessary paperwork with the Arizona Corporation Commission in order to form your LLC, as a new LLC member, you may be able to reduce your overall costs while still running your Arizona business.

How to Register your Painting Business Name in Arizona

If you are a sole proprietorship or general partnership in Arizona and intend to conduct business under your full first and last names, for example, John Smith, there is no filing required. However, if the business will operate under a trade name/business name such as John Smith’s Handyman Service, Mr. Handyman, or similar, you must complete a Trade Name Registration or DBA (Doing Business As).

While registration is not essential, it is suggested that the ownership of the firm must be established. This is frequently needed when opening a bank account or establishing a business relationship with a vendor.

Trade Name Registration with the Arizona Secretary of State will cost $10 and must be renewed every five years. The filing process will take approximately 2-3 weeks.

Arizona Corporation Commission

Employer Identification Number (EIN)

A 9-digit EIN or FEIN is given to identify a business by the IRS. Like your social security number, your company tax identification number serves as your identify while you’re paying your taxes.

Also included in your search for an EIN is the term FTIN (Federal Tax Identification Number), but be aware that it is incorrect terminology. In addition to social security numbers and EINs, individuals and corporations also utilize their SSNs and EINs as their FTINs.

Sole proprietorships with no workers are exempt from this requirement. In addition to being freelancers, independent consultants and sole owners are also sometimes regarded as sole proprietors.

Open a Business Checking Account

For freelancers, independent contractors, and self-employed individuals, a business checking account is strongly recommended. For company owners with small and medium-sized companies, specialized business bank accounts provide specialized services designed for enterprises.

As a company owner, having a personal checking account is beneficial when you’re starting, but you should instead open a separate account just for your business.

Freebie: Business Card Templates for Painting Contractors

Get Liability Insurance

General liability insurance is an additional layer of insurance that protects you against third-party claims for bodily injury, property damage, and personal harm. It is often referred to as commercial general liability insurance or simply company liability insurance.

Even a minor lawsuit can be financially devastating to a small firm. Even if the charges are untrue, you must retain legal counsel to defend yourself. If you are required to pay damages, monetary settlements, or judgments, this might mark the end of your already-depleted firm.

While proper business liability insurance might help you avoid considerable financial strain, you should first prepare for a lawsuit. By working with an independent insurance agent who understands your unique liability concerns, you may get general liability insurance and many bespoke products that give comprehensive protection to your organization.

Get Health Insurance

When insurance pays for medical expenditures, it can be described as health insurance. This type of group insurance, which is frequently utilized by smaller businesses, has been designed for their particular needs.

Depending on the size of the company, all enterprises are required by law to offer health insurance for their employees. Health insurance, even if not legally needed, may improve a small business’s brand, increase employee loyalty, and ultimately, aid in encouraging healthier lives among employees.

Final Thoughts

Finally, you will launch your business since you can foresee the future. Start-up businesses come with plenty of difficulties, whether it be a painting company or any other sort.

To build trust, you must show that you are trustworthy. Your responsibilities are to show the same level of interest in their living quarters/business establishment as you would your own. Adding excellent service to your business helps draw in new customers, gets you to repeat business, and instills consumer confidence. All that is necessary for all of this to be feasible is top-notch products, talented staff, and a fair price.