While the Great Recession put South Carolina on the path to slow growth, the state has continued to see moderate increases in its economic activity every year since then. Labor markets aren’t as intense as they were prior to the recent economic growth, which has led to a slightly higher rate of per capita personal income. South Carolinians enjoy a lower tax burden than the rest of the country.

The South Carolinians are pleased to undertake business activities in their state, and they are eager to profit from the healthy economic growth the state is experiencing.

Complete Guide: How to Start a Painting Business

How To Start A Painting Business In South Carolina

- Getting Started

- Write a Business Plan

- Determine your business’ legal structure

- How to Register your Painting Business Name in South Carolina

- Employer Identification Number (EIN)

- Open a Business Checking Account

- Get Liability Insurance

- Get Health Insurance

- Final Thoughts

Getting Started

It will not be difficult to get a painting business started in South Carolina, but you must be aware of a few key things before taking off your painter’s cap and going to work. In addition to helping you through the process of establishing your business, we’ll be sure to assist you to get the right insurance and licenses as well.

Write a Business Plan

A business plan is not required to start a business. However, having a business plan has numerous advantages. It serves as a business blueprint as well as telling you whether or not you have a good chance of earning a profit and how much you stand to make in a given timeframe.

While a business plan serves a number of useful purposes, such as defining the business and helping clients understand the goals, it’s also an efficient tool since it provides a clear picture of the business for the client and a sound understanding of how you intend to succeed in your business.

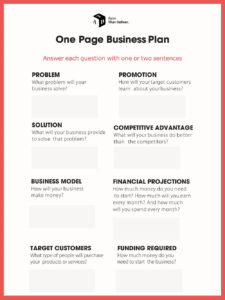

Create a One-Page Business Plan

You should be able to complete your one-page business plan in less than 20 minutes. It’s super-simple: Print our free PDF template and write down one to two sentences to the questions in the free template below:

Download template: PDF

Determine your business legal structure

The legal structure of a company that is accepted in a certain jurisdiction is referred to as business structure. The legal form of an organization determines what activities it may engage in, such as raising money, taking on the liabilities of the business, and how much it owes in taxes to the government. First, business owners should define their aims and requirements before deciding on the sort of legal structure.

In the United States, the four most often used and fundamental company legal structures are as follows:

- Sole Proprietorship

- Partnership

- Corporation

- Limited Liability Company or an LLC

Sole Proprietorship

The simplest business form is a sole proprietorship, in which the owner handles the daily operations of the firm. Also, company revenue and costs are reported on the owner’s tax return.

Because the business does not exist as a separate legal entity from its owner, the business is not needed to submit a separate income tax form from the owner. Self-employment tax is collected via filing Form 1040, which must contain Schedule C and Schedule SE.

Partnership

A partnership is a company structure that is formed when two or more owners agree to partner with each other. It is the simplest type of company structure for a firm with several owners. Like a sole proprietorship, a partnership shares many characteristics with a partnership. For example, the business and its owners are one legal entity, they are recognized as a single person.

However, the partners have responsibility for the business’s debts and commitments, and they may be forced to sell their personal assets to settle the debt. In addition, disputes between the company partners may slow down the firm’s operations.

Corporation

Corporations are complicated and expensive businesses. As a distinct legal body, it provides personal liability protection for its owners. Filing a corporation does need significant paperwork and costs and documents. A corporation can raise funds through selling shares, or by owning the company.

Limited Liability Company or an LLC

A new company structure in America is an LLC, which is known as a Limited Liability Company (LLC). The entity classification was established to be a hybrid entity, granting owners personal security and like a corporation, but also giving partnership and sole proprietorship tax benefits.

In contrast to a corporation, an LLC is a separate legal entity. Because members are not personally liable for the debt of the company, even if it goes bankrupt, the members aren’t liable for the debts of the firm. When you run your own business, you are allowed to record your business earnings and expenditure on your personal income tax.

How to Register your Painting Business Name in South Carolina

Are you interested in learning more about South Carolina company registration? Before you can begin operating your firm, you must register with the state, receive the necessary documentation, and secure any necessary licenses.

In South Carolina, business registration is handled by the Secretary of State (SOS). The Starting a Company part of the sc.gov website has information and resources to assist you in starting a small business.

On the South Carolina Business One Stop (SCBOS) website, you may obtain assistance with fundraising, recruiting personnel, licensing, and registration.

Employer Identification Number (EIN)

Employer Identification Numbers (EINs) are the nine-digit numbers that the Internal Revenue Service needs of business owners who pay employees. However, even if it is not necessary, there are compelling reasons to obtain an EIN: A tax identification number (EIN) can be used to open a business bank account, apply for business permits and loans, and file tax returns. Additionally, it enables business owners to issue a tax identification number that is distinct from their Social Security number. In this situation, the primary benefits of using an EIN would be privacy and protection against identity theft.

All types of businesses are eligible to apply for an EIN. However, the IRS requires firms to obtain an EIN if they meet the following criteria:

- A minimum of one employee should be compensated

- Establish a company or a partnership to conduct business.

- The following tax returns must be filed: Whether it is employment, excise, or alcohol, tobacco, or guns

- Withhold taxes from a non-resident immigrant’s income other than wages.

- Possess a tax-advantaged retirement plan. Employee pensions in the Keogh plan

Open a Business Checking Account

The general consensus is that your company will require a business checking account. To avoid getting in serious water with the IRS, one should keep his personal and company income separate. Proving the legitimacy of business deductions may be challenging if you use your personal checking account to pay for the deductions. Additional, if your personal and corporate accounts are a mess, you may be unable to collect deductions to which you are legally entitled.

If your firm is sued, mixing your personal and corporate finances may lead to legal problems. Companies and suppliers are far less likely to deal with you if you’re using your personal funds to write cheques. Customers expect you (and should have faith in you) to handle your business as well as pay their invoices.

In addition, if you wish to obtain a loan of some sort, you must first open a business checking account.

Freebie: Business Card Templates for Painting Contractors

Get Liability Insurance

An additional layer of insurance that insures you against third-party claims of physical injury, property damage, and personal harm is referred to as general liability insurance, which is also called commercial general liability insurance or simply business liability insurance.

Even a little lawsuit can have a substantial financial impact on a small business. Even if the claims are bogus, you still need to employ a lawyer to defend yourself. This could spell the final doom for your already depleted business if you have to pay damages or monetary settlements or judgments.

Although significant financial pressure can be avoided with adequate business liability insurance, you should first be prepared for a lawsuit. You can buy general liability insurance and several customized plans that provide complete protection for your operation by dealing with an independent insurance agent who understands your unique liability concerns.

Get Health Insurance

You may be thinking as a small business owner if you should give health insurance to your employees. Offering small business health insurance is a significant decision for any firm, and you may have questions about why you might want to include health care as an employee perk.

You may be surprised to hear that small business health insurance can assist your organization in a variety of ways. Not only do small company health insurance plans benefit employees, but employers may discover that a group plan benefits them in a variety of ways as well.

Final Thoughts

Now that you’ve discovered all of the answers to your “How to Start a Painting Business in South Carolina” queries, we hope you’ll have the wisdom to begin your business. A start-up business such as a painting business will always be difficult.

To acquire someone’s trust, you must demonstrate that you can be trusted. You must give the same amount of attention to their home/workplace as you would to your own. An excellent service will increase your company’s appeal, enhance customer confidence, and encourage repeat business. All of this is possible when top-notch products, well-trained employees, and fair pricing are used.