With the nation’s 7th highest access to SBA funding, starting a business is a perfect option for entrepreneurs in Wisconsin. Start today with our clear step-by-step guide to your painting business and progress to financial and personal freedom.

It is just the beginning to find the right place to start your company. Once you have agreed to open your company in Wisconsin, there are a few measures to be consistent and to start earning income. In just a few days you can start a painting business here, but you must take the time to plan properly.

Complete Guide: How to Start a Painting Business

How To Start A Painting Business In Wisconsin:

- Getting Started

- Write a Business Plan

- Determine your business’ legal structure

- How To Start A Painting Business In Wisconsin

- Employer Identification Number (EIN)

- Open a Business Checking Account

- Get Liability Insurance

- Get Health Insurance

- Final Thoughts

Getting Started

In order to be successful, painting contractors need to know a range of painting techniques and how to bid on projects, predict project costs and hire staff. In most states, you must first apply for licenses, obtain liability insurance and file the documents required to recognize your business before you can start operating as an independent painting contractor.

Write a Business Plan

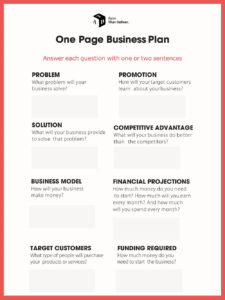

A good business plan can direct you through the various stages of starting and managing a business. Your business plan will serve as a road map for structuring, operating, and growing your business endeavor. It’s a method for considering the critical components of your market.

Business plans will assist you in obtaining financing or attracting new business partners. Investors want to be sure that their investment will generate a profit. Your business plan is the vehicle by which you can persuade others that partnering with you — or investing in your company — is a smart choice.

Create a One-Page Business Plan

You should be able to complete your one-page business plan in less than 20 minutes. It’s super-simple: Print our free PDF template and write down one to two sentences to the questions in the free template below:

Download template: PDF

Determine your business legal structure

The popularity of the company system varies according to the small business administration (SBA), depending on how many, if any, employees you have.

You have a few choices when you decide on your business. There are five business structures to choose from, according to the IRS:

- Sole proprietorship

- Partnership (general, limited, or limited liability partnerships)

- Limited Liability Company (single-member or multi-member LLC)

- Corporation

- S Corporation

The majority (86.4%) of non-employer enterprises have a sole proprietor arrangement. Keep in mind that you can also be a single employee-owner. S Corps constitute the majority (47.3%) of small businesses. Although the concept of small employers varies by sector, small employers are usually 500 or fewer workers. However, some businesses can hire up to 1,500 people and are still small under the SBA.

For big employers, the majority structure as corporations (75.9 percent ). The broad employer classification relies on the sector using the SBA size standards.

Wisconsin One Stop Business Portal

How to Register your Painting Business Name in Wisconsin

For LLCs and companies, you must ensure that your business entity’s name is distinct from those already on file with the Wisconsin Department of Financial Institutions (DFI). You can determine if a name is available by conducting a business entity search on the DFI website. By submitting a Name Reservation Application (Form 1) to the DFI, you can reserve an available name for 120 days. Certain name conditions apply to LLCs and companies (such as using the term “LLC” or “Company” in the name of an LLC or “Company” in the name of a corporation).

Is your company a sole proprietorship or a partnership that operates under a business name that is distinct from the business owner’s legal name (in the case of a sole proprietorship) or from the surnames of the individual partners (in the case of a partnership)? If this is the case, you will register your firm’s name with the Register of Deeds in the county in which your business is located.

Employer Identification Number (EIN)

An EIN is a tax identification number assigned by the Internal Revenue Service to a business. On bank account applications, income tax forms, and job tax reports and payments, you must have your business’s tax identification number.

Any business with employees is needed to have an employer identification number (EIN), but you may need one even if your business does not have employees, at least initially. It is, in essence, the Social Security number for your business. The term “Employer ID Number” is somewhat misleading, as companies without workers often need one.

You may want to consider obtaining an EIN just to be safe—it will be available if you are ever required to have one. It’s free, so why not make a small-time investment?

Freebie: Business Card Templates for Painting Contractors

Open a Business Checking Account

Having a business checking account gives your small business professionalism and reputation, even though it began as a hobby. When payments and purchases are made from an account under your business’s name, your clients and customers can feel more secure.

Additionally, maintaining a company checking account enables you to accept credit card payments from employers and consumers, as such payments cannot be accepted from your personal account without the assistance of a payment service provider (and paying stiff fees). Accepting all payment types enhances professionalism in the eyes of your customers while also growing your business’s earning potential.

Get Liability Insurance

Each company is exposed to some degree of risk, which is why the majority of businesses need liability insurance. This coverage will assist in defending your company against charges such as malpractice or bodily harm that can result in lawsuits or legal liabilities.

The amount of coverage you need is determined by the type of company you operate, since each business faces specific risks. For example, construction businesses may need higher liability limits than retail establishments. Additionally, there are various forms of liability insurance coverage to consider while shopping for a policy.

The three primary categories of liability insurance coverage are as follows:

- General liability

- Professional liability

- Employer liability

Get Health Insurance

Small businesses may choose to provide health insurance to their employees because it has a number of advantages for both the employees and the business.

Offering health care coverage to the workers will help retain them. Additionally, it may assist in attracting new employees to your business. According to a new Glassdoor study, health insurance is the most valuable perk for employee happiness, surpassing holiday and retirement benefits.

Employer health insurance costs are tax deductible, which can significantly minimise or even eliminate the tax obligation. Additionally, the investments are tax deductible, which means you can subtract the cost of employer-sponsored contributions on the tax return. By providing health benefits to your employees, you might also be eligible for the Small Business Health Care Tax Credit.

Final Thoughts

To be a successful entrepreneur, you must have a product or service that consumers want and that you can sell profitably. And, of course, it’s not just about the money; it requires dedication and long hours as well. However, with some preparation and some capital, you can overcome the odds and start and develop a profitable painting company.

Complete Guide: How to Start a Painting Business